The 2026 GHG Reporting: What Changed & How to Adapt

Navigating the Shift from Narrative Reporting to Audit-Grade Precision

The European sustainability landscape has shifted gears. We are no longer in the phase of “regulatory panic” where every week brought a new directive. By February 2026, we have entered the era of operational precision.

For sustainability leaders, the goal has moved from simply understanding the rules to building a system that can withstand the scrutiny of banks, auditors, and supply chain partners. Here is an educational breakdown of the new reporting reality—and why this “quiet” period is actually the most critical time to act.

1. The “Stop-the-Clock” & Omnibus I: A Strategic Pause, Not a Full Stop

In late 2025, the EU introduced the Omnibus I simplification package to boost competitiveness. This legislation narrowed the scope of mandatory CSRD reporting, focusing on the largest entities (those with >1,000 employees and >€450 million turnover).

- The “Stop-the-Clock” Effect: Many mid-market companies (Wave 2 & 3) saw their mandatory reporting deferred to the 2028 cycle.

- The Market Reality: While the legal timeline has shifted, market expectations remain immediate. Banks still need your Green Asset Ratios. Large customers still need your Scope 3 data for their own reports.

- The Educational Takeaway: Treat this delay as a “prep period.” The companies that will thrive in 2028 are the ones using this time to transition from spreadsheets to audit-grade systems.

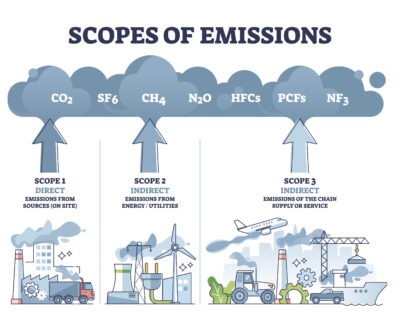

2. The New Math of GHG Accounting

Under the ESRS E1 standard, “estimating” your carbon footprint is no longer sufficient. The 2026 requirements demand verifiable data across three scopes, and the precision required has increased significantly.

-

Scope 1 & 2: Direct Assets and Energy Consumption: These represent the emissions your company “owns” or controls directly. To meet the 2026 standard, you must move away from spending-based estimates toward metered data.

-

Scope 1 (Direct): This includes the physical fuel burned in your company vehicles, the gas used to heat your offices, and even the refrigerant gases that might leak from your HVAC systems.

-

Scope 2 (Indirect): This is the electricity, steam, or cooling you purchase. You now need to prove the “greenness” of your power through Guarantees of Origin or specific utility contracts, rather than just using a national average.

-

-

Scope 3 & The “Value-Chain Cap”: Your Indirect Footprint: Scope 3 covers emissions that occur outside your four walls—both upstream and downstream. Because this data comes from third parties, it is often the most complex to track.

-

Upstream Sources: This includes the carbon footprint of the raw materials you buy (like steel or plastic), the emissions from the trucks that deliver your goods, and even the “business travel” of your employees on flights or trains.

-

Downstream Sources: This covers the energy used by customers when they use your products and the emissions generated when your product is eventually recycled or disposed of as waste.

-

The “Value-Chain Cap”: To prevent small suppliers from being overwhelmed, the 2026 rules allow you to use industry-average “proxy” data for smaller partners. This means you only need to “chase” primary data from your most significant, high-impact suppliers.

-

3. The Rise of the “SME Shield” (VSME)

One of the most important educational concepts for 2026 is the Voluntary Sustainability Reporting Standard for SMEs (VSME).

- The Problem: In the past, a small supplier might receive 50 different questionnaires from 50 different clients, each asking for data in a slightly different format.

- The Solution: The VSME acts as a “shield.” By reporting against this one standard, an SME provides a single, validated data set that satisfies all partners. It standardizes the data exchange, meaning a small machine shop can “report once, share everywhere.”

4. Financial Stakes: Greenwashing & Carbon Pricing

Reporting has evolved from a communications function into a critical risk management tool.

- The Green Claims Directive: The directive emphasizes substantiation; claims like ‘eco-friendly’ now require a rigorous scientific baseline to ensure compliance and protect company reputation. Every claim must be substantiated.

- CBAM (Carbon Border Adjustment Mechanism): This is now in its definitive phase. If you import steel, iron, or aluminum, you are paying for the embedded carbon. Accurate GHG data is now a direct line item on your procurement budget.

How Planmark Solves These Specific Challenges

While our previous post discussed how AI saves time, let’s look at how Planmark specifically addresses these structural and mathematical challenges of the 2026 landscape.

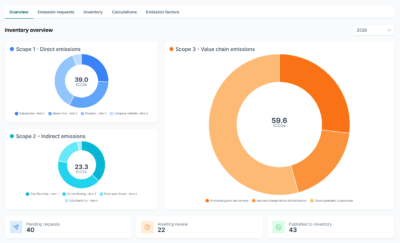

Mastering Value Chain Control within Planmark: Managing data across complex corporate hierarchies and extended value chains is a core function integrated directly into the Planmark platform

-

The Fix: Planmark addresses the Scope 3 challenge by supporting the Voluntary Sustainability Reporting Standard for SMEs (VSME) framework

. Rather than relying on a manual “email chase,” suppliers use secure, standardized data exchange tools and ready-made templates to submit their information . This validated data flows directly into your Scope 3 calculations, replacing fragmented files with a structured, automated workflow that provides a smoother experience for both you and your partners .

Automating the “Math” of Compliance: The days of manually looking up emission factors are over. Planmark’s Carbon Accounting module automates the complex calculations for Scope 1, 2, and 3.

- The Fix: The system uses built-in, up-to-date factor libraries to eliminate human error. It handles the specific “market-based” vs. “location-based” calculations required by ESRS E1, providing the mathematical precision needed to defend against Green Claims Directive scrutiny.

The “Audit-Ready” Data Vault: With the shift to “limited assurance,” your data must be traceable.

- The Fix: Planmark creates a digital thread for every number. Planmark provides instant traceability. Rather than manual data retrieval, you can instantly reference the specific invoice or meter reading behind any figure. You click a button, and the system shows the exact invoice or meter reading that generated that number. This “Data Vault” approach ensures you are always ready for external verification.

Future-Proofing for 2028: The regulatory landscape will continue to evolve.

- The Fix: Planmark’s platform is designed to adapt. As rules like the Omnibus package change, the system updates its frameworks. This allows your team to use the “Stop-the-Clock” period effectively—building a robust, historical data baseline so that when mandatory reporting hits in 2028, you aren’t starting from scratch; you’re just pressing “print.”

Ready to turn compliance into a competitive advantage? Book a Demo today to see how our ESG Intelligence platform can simplify your 2026 reporting journey.